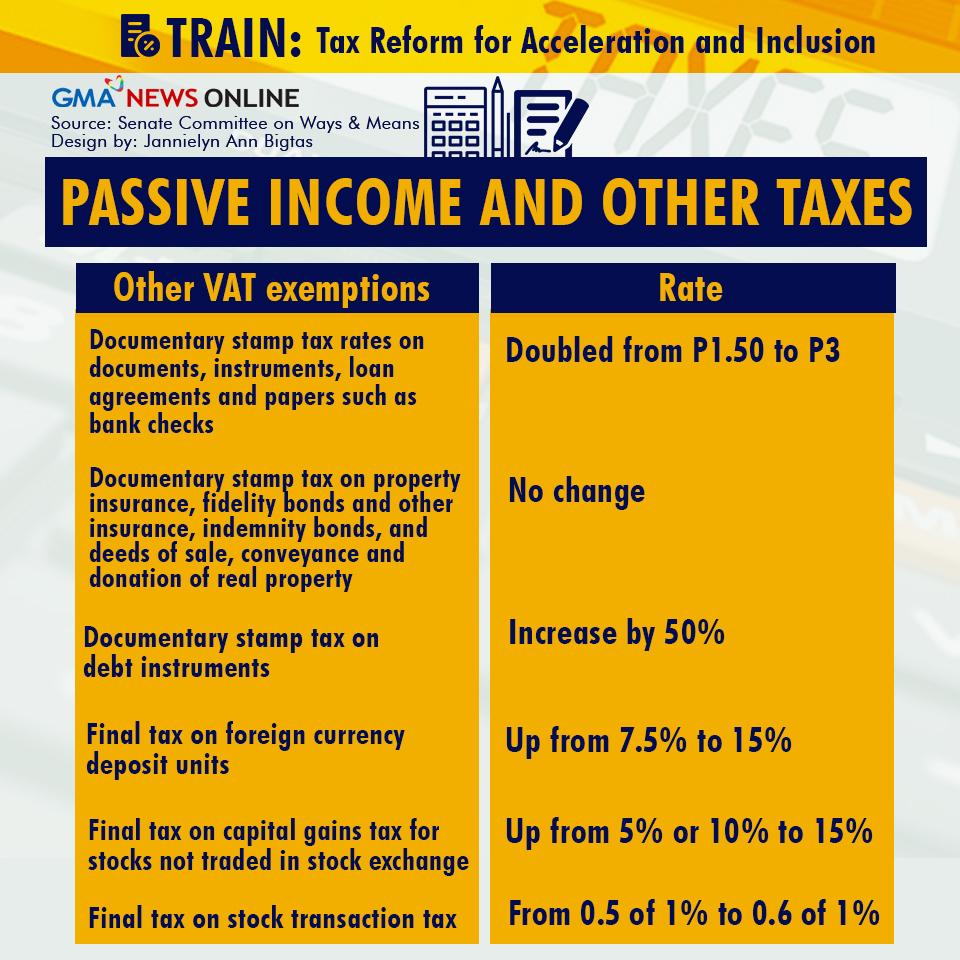

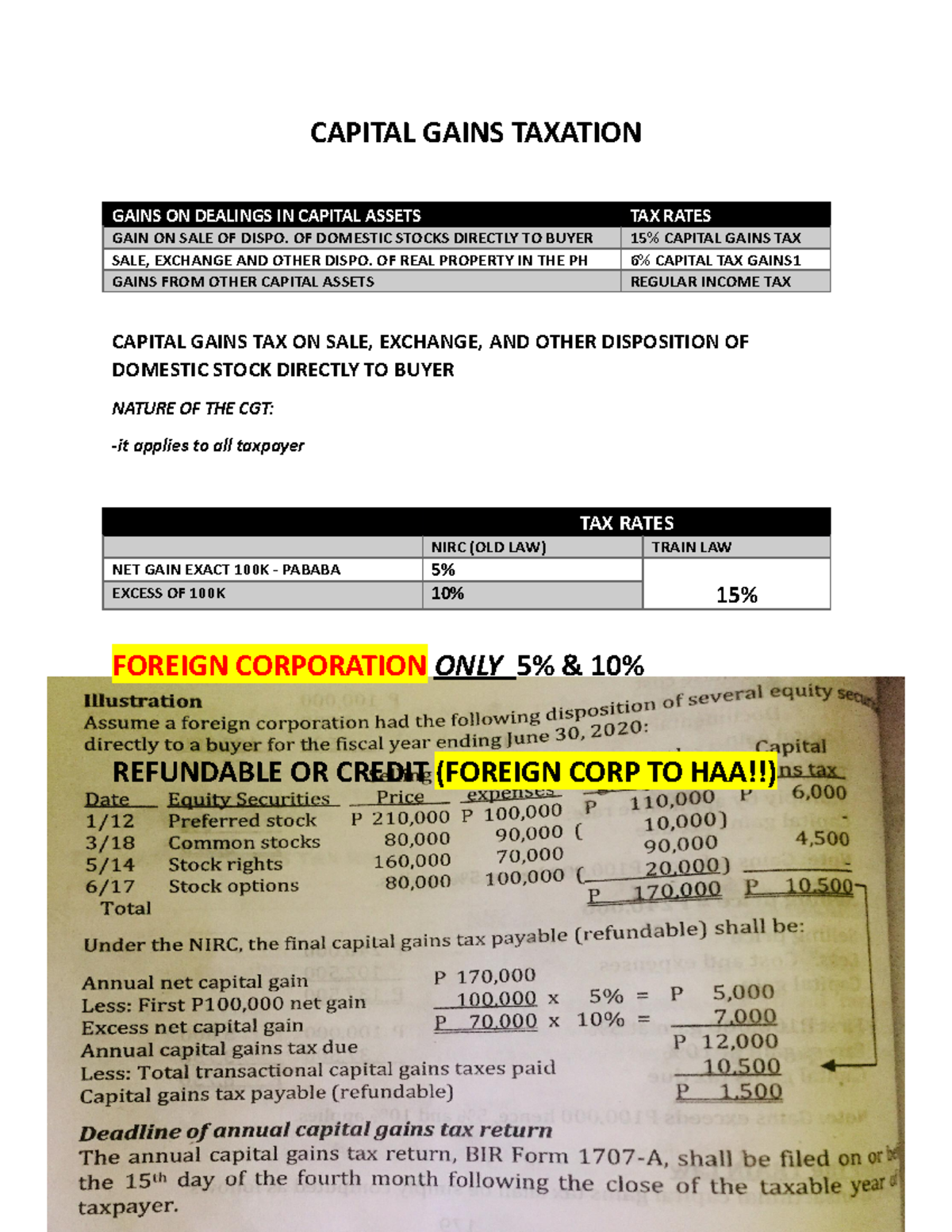

Capital Gain Tax Rate 2025 Philippines. Capital gain tax rate 2025 philippines. 5% and 10% if the seller is a foreign corporation.

Exemptions are available for those reinvesting in a principal residence within a. Current long term capital gains tax rate 2025 nj.

Capital Gains Tax Rate 2025 Philippines Manda Rozanne, Generally, capital gains are taxed as regular income.

Capital Gains Tax Rate 2025 Ddene Esmaria, According to the philippine tax code, capital gains tax is a tax that is imposed on earnings that the seller has gained from the sale of capital assets.

2025 Lunar Calendar Philippines Capital Gains Tax Rasia Catherin, Use our capital gains tax calculator for the philippines to compute the real estate cgt you have to pay on the sale of property in the philippines.

Capital Gains Tax Rate 2025 Philippines Manda Rozanne, 15% of the tax base if the seller is a domestic corporation or an individual.

Long Term Capital Gains Tax Rate 2025 Table In Sap Barrie Miguelita, Generally, capital gains are taxed as regular income.

Capital Gain Tax Rates 2025 Myrta Tuesday, This guide provides a detailed overview of, what is a capital.

Tax On Long Term Capital Gains 2025 Gail Paulie, Exemptions are available for those reinvesting in a principal residence within a.

Capital Gains Tax Calculator 2025/25 Lexy Sheela, You’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300.

Capital Gains Taxations CAPITAL GAINS TAXATION GAINS ON DEALINGS IN, Real estate capital gain tax rate 2025 ange maggie, budget 2025 changes capital gains tax with two holding periods, impacting investments like stocks, real estate, and mutual.

Tax Rate Long Term Capital Gains 2025 Trude Hortense, Capital gains tax is a tax imposed on the gains presumed to have been realized by the seller from the sale, exchange, or other disposition of capital assets located in the.